TAX EQUITY

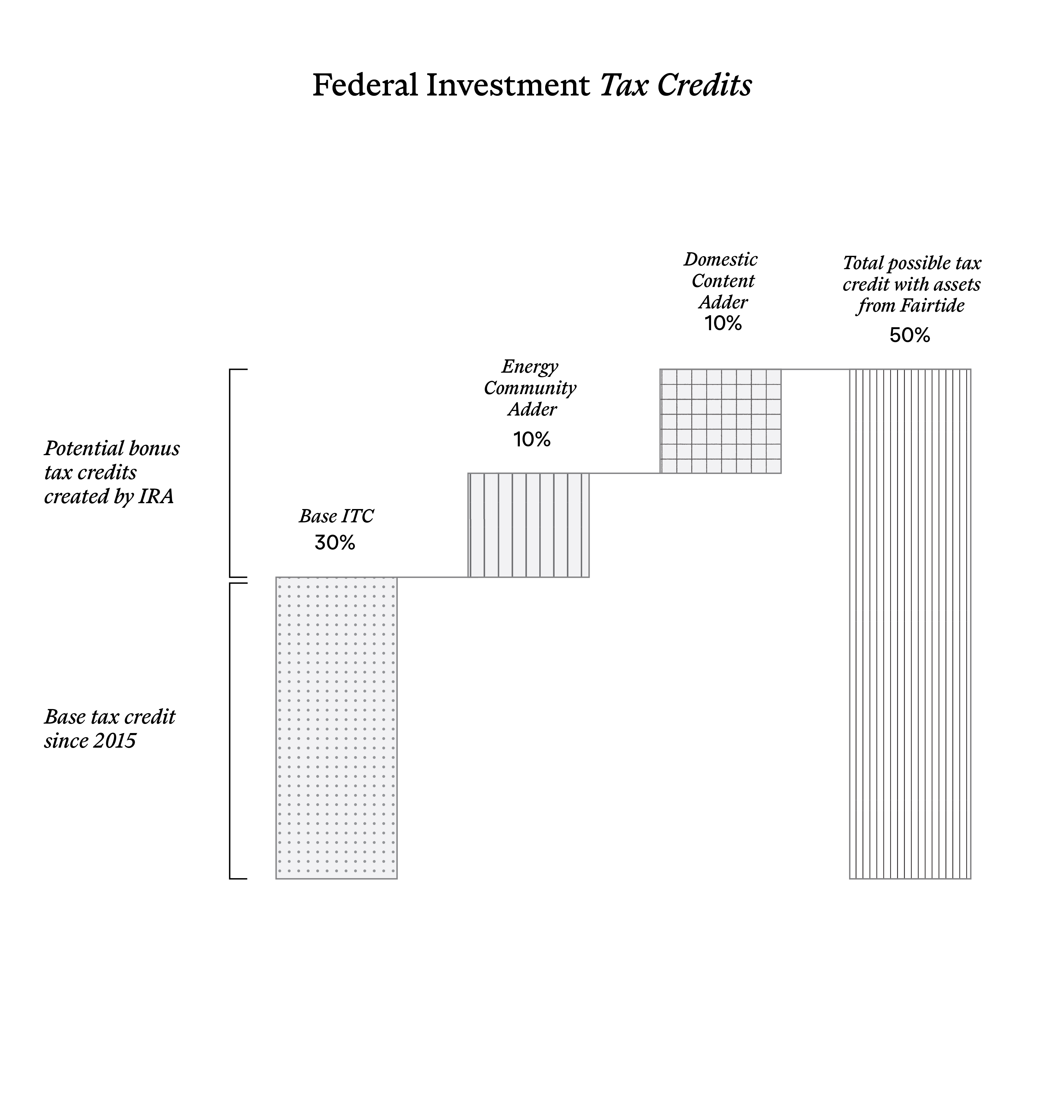

Federal Investment Tax Credits

Fairtide battery and solar assets qualify for federal investment tax credits and bonus depreciation that may be used to reduce tax liabilities.

"Tax equity is a way sophisticated investors can compound alpha faster."

Nat Kreamer

An Institutional Asset Class

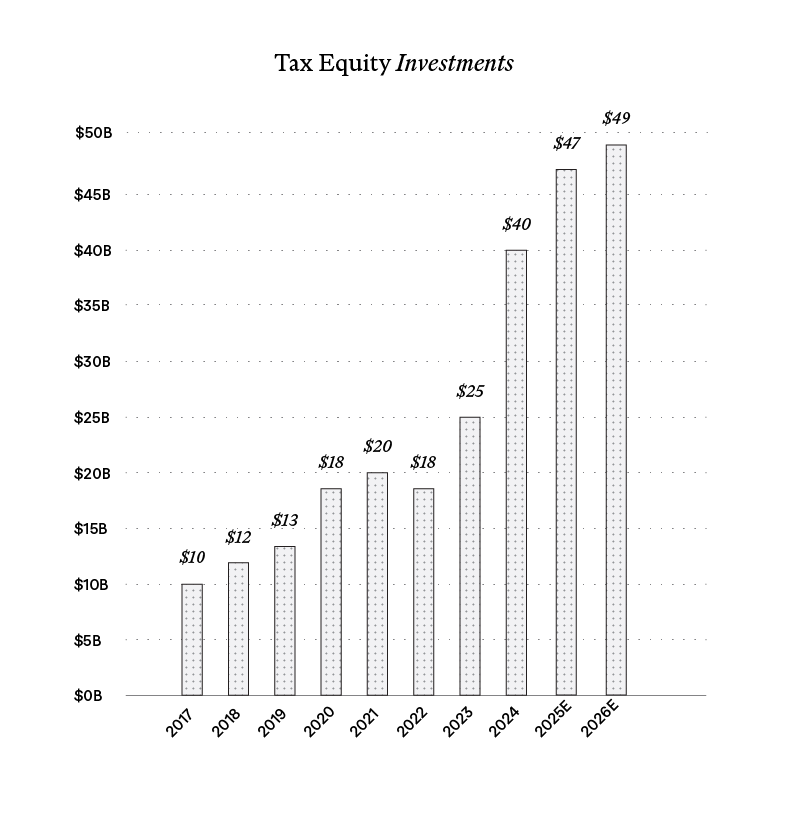

Tax equity is a ~$40B market in the US, led by Fortune 500 companies that reduce their effective tax rates by using depreciation deductions and tax credits from renewable energy projects they own.

Contact Us

Sources:

2017-2023: Marathon Capital Research

2024: Norton Rose & Fulbright, Cost of Capital 2025

2025-2026: Reunion Infrastructure, Market Sizing of the Transferable Tax Credit Market, December 2025

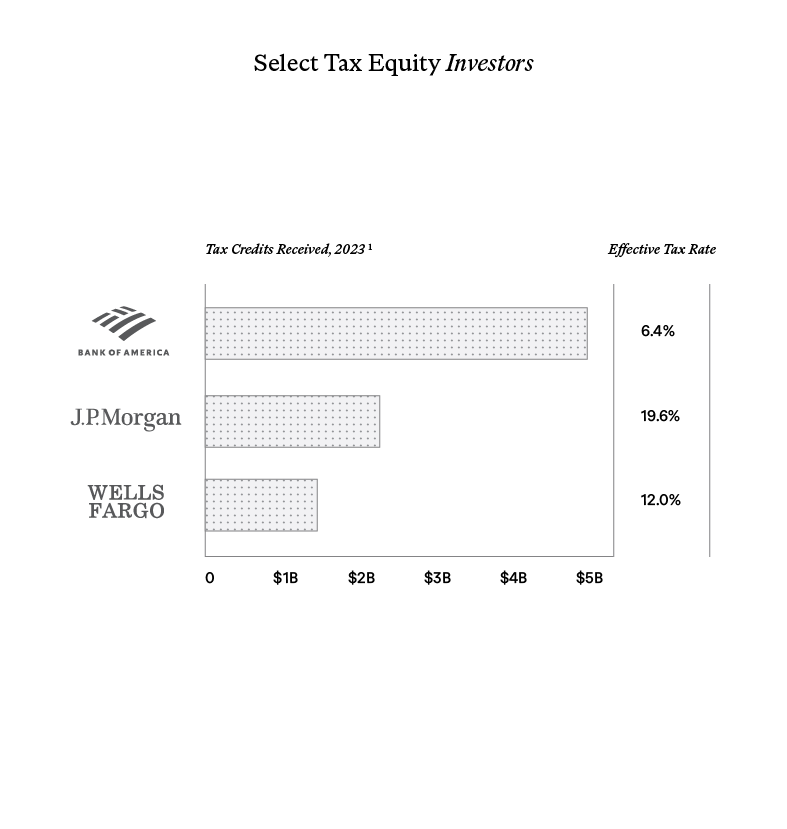

Source: Annual 10K reports1 (includes tax credits and benefits, where reported together, from all sources)

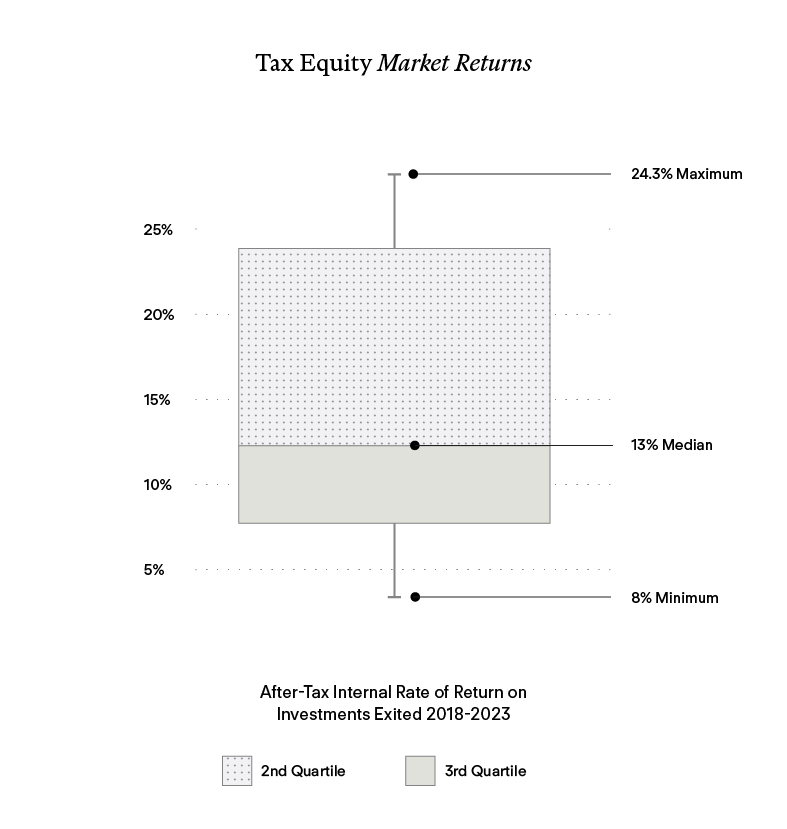

Source: ACORE, The Risk Profile of Renewable Energy Tax Equity Investments (December 2023)

- Each company is not a current investor in Fairtide.

Be In Good Company

Harnessing the income and tax benefits1 of renewable energy infrastructure investment is a strategy used by certain large institutional investors to reduce tax liabilities and increase returns.2

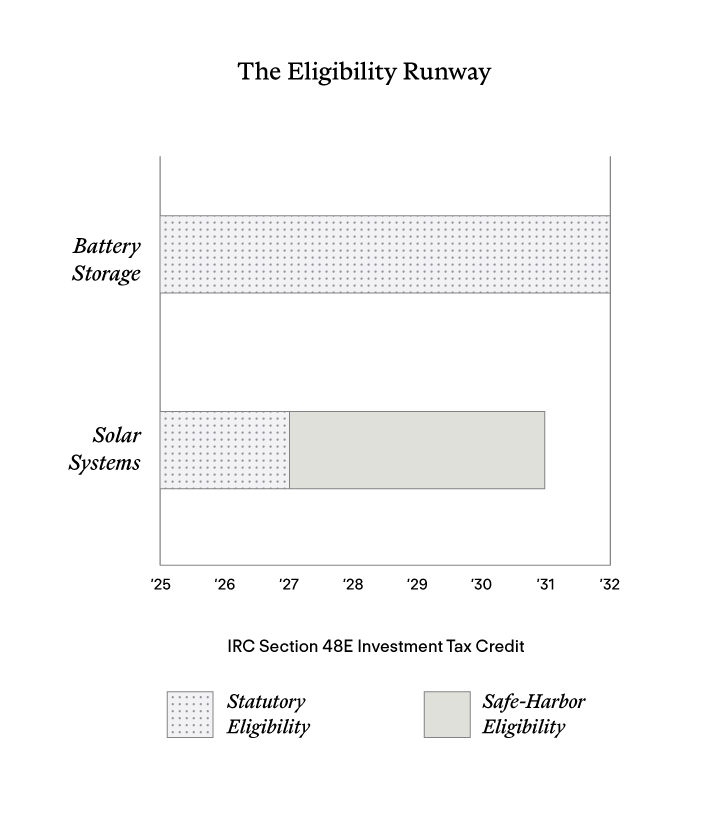

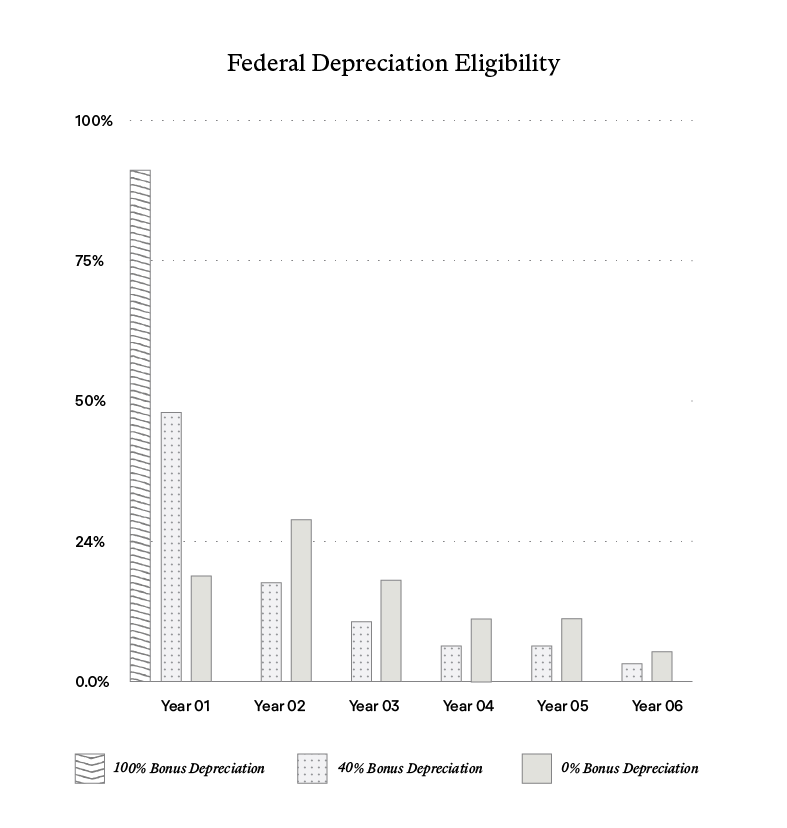

- Photovoltaic solar (“solar”) and battery energy storage system (“BESS”) assets are eligible for Federal investment tax credits (“ITC”) and depreciation deduction per Section 48 and its successors of the US Internal Revenue Code.

- Corporations such as Bank of America, JP Morgan, and Wells Fargo own an interest in renewable energy assets and receive tax benefits from them according to their 2023 Annual 10K filings.

Understanding Tax Credits and Depreciation

The core components of renewable energy tax equity strategy are depreciation deductions and tax credits. These benefits offer attractive and timely value to investors by reducing their cash tax liabilities.

Contact Us

Source: The US Internal Revenue Code 202

Source: The US Internal Revenue Code 2026

Source: The US Internal Revenue Code 2026

Message Us