Advanced Energy Technology

Fairtide acquires residential and small commercial battery storage and solar assets from our proprietary developer.

Contact Us

Contact UsSTRATEGY

A renewable-energy asset investment strategy

At a time when utility-scale energy generation takes years to build, distributed power generation offers a rapidly-deployable alternative. Customer-sited energy assets may provide value where power is most expensive: the point of demand.

FAIRTIDE’S EXPERIENCE

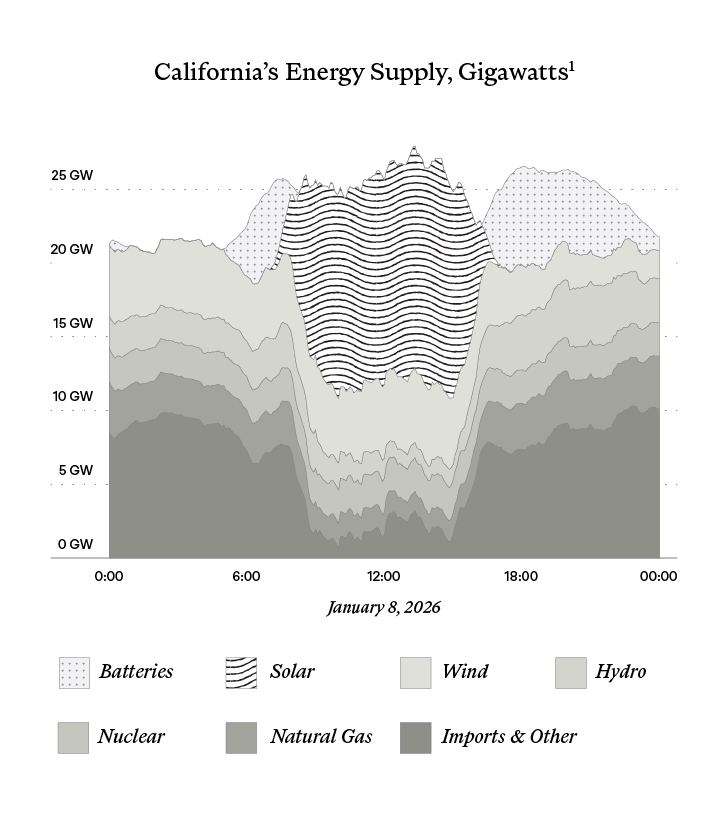

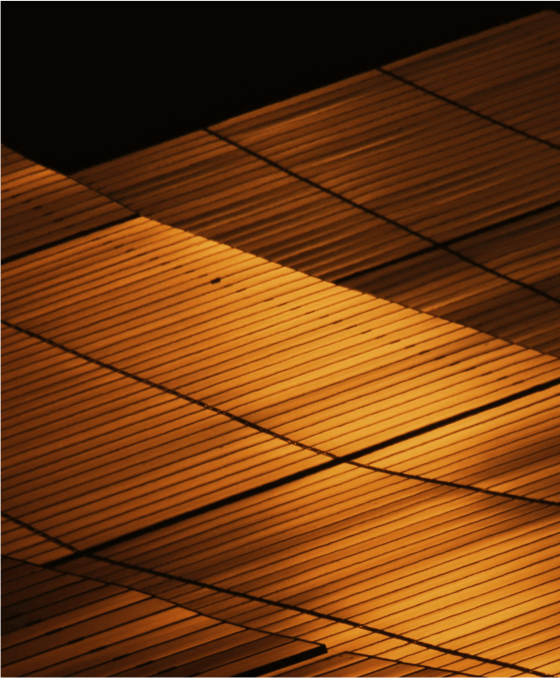

Today, solar coupled with battery storage is the largest source of new power generation in the US1, a trend that we believe will only accelerate as technology improves.

Pairing solar with home battery storage offers customers an attractive alternative to legacy energy: instant power when customers want it, even when the grid goes down.

While the inflation-adjusted cost of coal and oil has remained steady, solar and battery unit economics are rapidly improving, driving what The Economist calls “an exponential growth in solar power that will change the world.”

"Clean technologies replacing fossil commodities is a once-in-a-century economic opportunity."

Nat Kreamer

Fairtide helps investors benefit from battery and solar infrastructure assets.

These assets earn cash from selling energy services to homeowners and businesses, create tax credits, and benefit from depreciation deductions. They may also be eligible for ancillary revenues from the sale of environmental attributes and energy services to utility system operators.

Fairtide acquires residential and small commercial battery storage and solar assets from our proprietary developer.

Ownership of the solar and battery assets yields value through cash from customer payments, as well as federal and state tax benefits—depreciation deductions that may reduce taxable income and tax credits that reduce taxes paid.

The most valuable point in the energy ecosystem is at the load center. Fairtide's renewable energy assets are customer-sited, creating the opportunity to benefit from increasing energy demand.

Fairtide’s asset strategy seeks to deliver benefits to customers, suppliers, and investors.

Generally, homeowners and businesses lower their energy bills by using an Energy Services Agreement (ESA)1, which is an attractive alternative to purchasing a battery or solar system outright.

Because selling power is easier than selling hardware, an ESA helps suppliers expand their addressable market.2

Investors can earn cash and tax benefits. While tax credits and depreciation have little value to most Americans—87% of whom take the standard deduction3—they have great value to qualifying taxable investors.

How We Create Assets

Learn about our energy development partner.