SEEKING RETURNS WITH TAX-ADVANTAGED RENEWABLE ENERGY ASSETS

An original strategy with uncommon benefits.

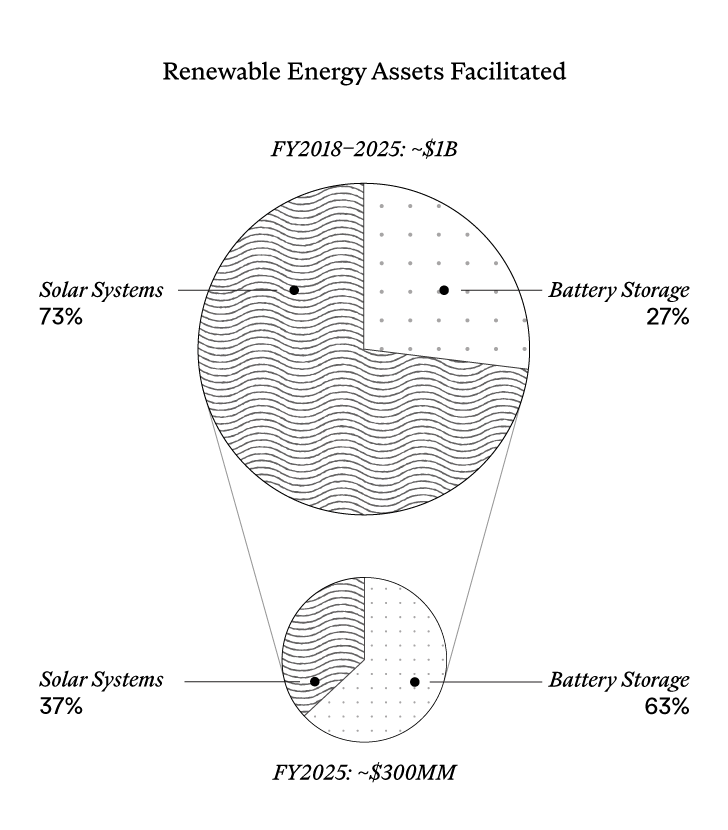

Fairtide seeks to harness the increasing demand for energy by creating renewable energy assets with the goal of delivering attractive cash returns and tax benefits to professional investors.

See the strategy

- As of December 31, 2025

The sustainable energy transition is creating new opportunities.

Building Tax Equity

Reduce investors’ income tax liability with energy tax benefits.1

- Qualifying investors that own renewable energy assets that receive investment tax credits and depreciation deductions may be eligible to reduce their cash taxes.

Growing New Ventures

Fairtide seeks to identify, develop, and grow companies that create and deploy sustainable technologies.

Helmed by Pioneers

Fairtide is led by renewable energy industry leaders and innovators. We know these strategies work, because we created and personally invested in the underlying businesses, policies, and financial products ourselves.